Understanding Rate Locks: Why Longer Locks Come with Higher Costs

When you apply for a mortgage, one of the most crucial decisions you'll face is locking in your interest rate. But why do longer rate locks tend to cost more? It all comes down to risk—both for you and the lender.

The Role of Interest Rate Fluctuations

Between the time you apply for a loan and the moment you close, interest rates will fluctuate. Sometimes, these changes are subtle, but they can also be quite volatile, even shifting from one minute to the next. Locking in your rate serves as a safeguard against rising rates, much like purchasing an insurance policy.

The Lender's Perspective: Risk Management

When you lock in your rate, you're effectively transferring the risk of rising rates to the lender. To manage this risk, lenders often purchase financial instruments called "hedges," such as U.S. Treasury Bonds, which move inversely to interest rates. However, these hedges come at a cost. The longer the lock period, the more expensive the hedge, which is reflected in the cost of your loan.

How Loan Type Influences Rate Lock Costs

The type of loan you're considering can also influence the cost of a rate lock. Some loans, like adjustable-rate mortgages (ARMs), are tied to indexes that move more slowly compared to the daily fluctuations in the broader market. This reduced volatility can result in lower costs for longer rate locks.

Making the Right Decision for You

Predicting interest rate movements is nearly impossible, which is why choosing the right rate lock duration often comes down to personal comfort. If the thought of fluctuating rates makes you uneasy, opting for a longer lock—even at a higher cost—might be worth the peace of mind. On the other hand, if you're comfortable with a bit of risk, a shorter lock could potentially save you money.

Whatever your choice, we're here to guide you through the process and ensure you feel confident every step of the way.

Move Up with a Bridge Loan and bridge the gap in financing between your current home and your dream home!

Buying a new home before you can sell your old one can present quite the financial conundrum. This is mostly because you have to come up with the cash for a new property when you don’t have access to the home equity you have already built up in your existing property. That’s where a bridge loan comes in.

What is a Bridge Loan?

A bridge loan, also called a “wrap” or “gap financing,” allows borrowers to purchase new property by accessing the equity in their current property before it’s sold.

How does a Bridge Loan Work?

While bridge loans can come in different amounts and last for varying lengths of time, they are meant to be short-term tools. Generally speaking, bridge loans are temporary financing options intended to help real estate buyers secure initial funding that helps them transition from one property to the next.

Let’s say you found your dream home and need to buy it quickly, yet you haven’t had the time to prepare your current residence for sale, let alone sell it. A bridge loan would provide the short-term funding required to purchase the new home quickly, buying you time to get your current home ready for sale. Ideally, you would move into your new home, sell your old property, then pay off the loan.

Program Details:

-

Perfect for borrowers in a seller’s market

-

Fast & flexible underwriting and execution

-

$500,000 Minimum loan amount

-

1-4 Unit Single Family Residence

-

Primary residences, second homes and investment properties

The Fine Print

-

Property must be listed on MLS

-

55% maximum LTV

-

Requires excellent credit - 680 minimum FICO

-

Higher DTI ratios considered

Bridge loans are the kind of loan you look to obtain when you need to move forward and you can’t do it any other way. If you are dead-set on purchasing a property but struggle to make the financials work, a bridge loan could truly save the day.

Click here to Contact Greenway today to see if you could qualify for a Bridge Loan!

As more and more baby boomers enter retirement age, the question of whether or not to sell their homes and move will become a hot topic. In today’s housing market climate, with low available inventory in the starter and trade-up home categories, it makes sense to evaluate your home’s ability to adapt to your needs in retirement.

According to the National Association of Exclusive Buyers Agents (NAEBA), there are 7 factors that you should consider when choosing your retirement home.

1. Affordability

“It may be easy enough to purchase your home today but think long-term about your monthly costs. Account for property taxes, insurance, HOA fees, utilities – all the things that will be due whether or not you have a mortgage on the property.”

Would moving to a complex with homeowner association fees actually be cheaper than having to hire all the contractors you would need to maintain your home, lawn, etc.? Would your taxes go down significantly if you relocated? What is your monthly income going to be like in retirement?

2. Equity

“If you have equity in your current home, you may be able to apply it to the purchase of your next home. Maintaining a healthy amount of home equity gives you a source of emergency funds to tap, via a home equity loan or reverse mortgage.”

The equity you have in your current home may be enough to purchase your retirement home with little to no mortgage. Homeowners in the US gained an average of over $14,000 in equity last year.

3. Maintenance

“As we age, our tolerance for cleaning gutters, raking leaves and shoveling snow can go right out the window. A condominium with low-maintenance needs can be a literal lifesaver, if your health or physical abilities decline.”

As we mentioned earlier, would a condo with an HOA fee be worth the added peace of mind of not having to do the maintenance work yourself?

4. Security

“Elderly homeowners can be targets for scams or break-ins. Living in a home with security features, such as a manned gate house, resident-only access and a security system can bring peace of mind.”

As scary as that thought may be, any additional security and an extra set of eyes looking out for you always adds to peace of mind.

5. Pets

“Renting won’t do if the dog can’t come too! The companionship of pets can provide emotional and physical benefits.”

Evaluate all of your options when it comes to bringing your ‘furever’ friend with you to a new home. Will there be necessary additional deposits if you are renting or in a condo? Is the backyard fenced in? How far are you from your favorite veterinarian?

6. Mobility

“No one wants to picture themselves in a wheelchair or a walker, but the home layout must be able to accommodate limited mobility.”

Sixty is the new 40, right? People are living longer and are more active in retirement, but that doesn’t mean that down the road you won’t need your home to be more accessible. Installing handrails and making sure your hallways and doorways are wide enough may be a good reason to look for a home that was built to accommodate these needs.

7. Convenience

“Is the new home close to the golf course, or to shopping and dining? Do you have amenities within easy walking distance? This can add to home value!”

How close are you to your children and grandchildren? Would relocating to a new area make visits with family easier or more frequent? Beyond being close to your favorite stores and restaurants, there are a lot of factors to consider.

Bottom Line

When it comes to your forever home, evaluating your current house for its ability to adapt with you as you age can be the first step to guaranteeing your comfort in retirement. If after considering all these factors you find yourself curious about your options, we can connect you with one of the many realtors with whom we have a great relationship. They can help evaluate your ability to sell your house in today’s market and we can help you finance your dream retirement home!

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family, others might think they are too young, and still, others might think their current income would never enable them to qualify for a mortgage.

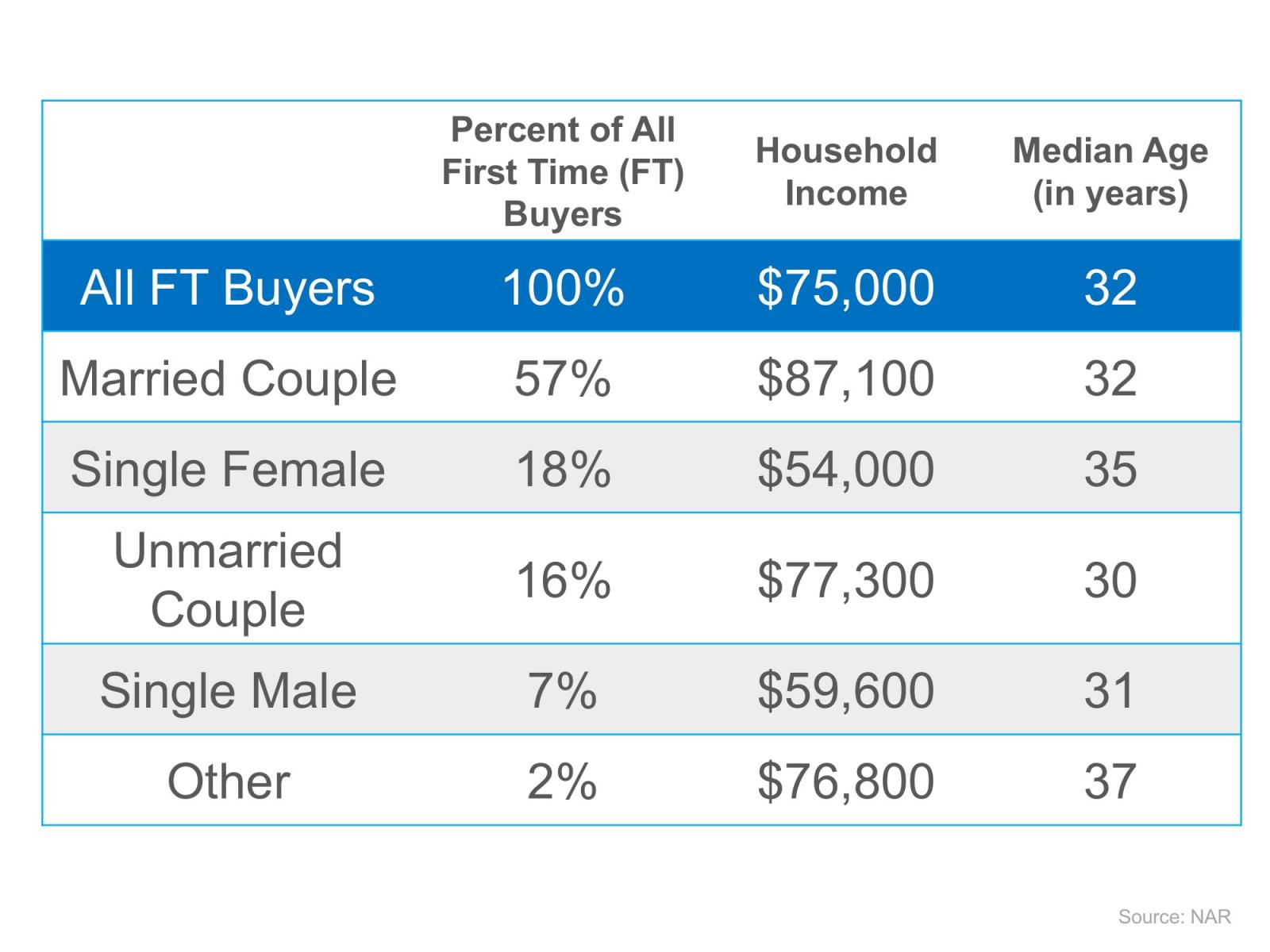

We want to share what the typical first-time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first-time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first homes. Let’s meet to determine if your dream home is within your grasp.

According to the National Association of Realtors’ latest Realtors Confidence Index, 61% of first-time homebuyers purchased their homes with down payments below 6% from October 2016 through November 2017.

Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying. The median down payment for all buyers in 2017 was just 10% and that percentage drops to 6% for first-time buyers.

Zillow Senior Economist Aaron Terrazas’ recent comments shed light on why buyer demand has remained strong,

“Looking into 2018, rent is expected to continue gaining. More widespread rent growth could mean home buying demands stay high, as renters who can afford it move away from the unpredictability of rising rents toward the relative stability of a monthly mortgage payment instead.”

It’s no surprise that with rents rising, more and more first-time buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

Bottom Line

If you are one of the many first-time buyers who is not sure if you would qualify for a low-down payment mortgage, contact a Greenway mortgage professional to get started on your path to homeownership!

.png)